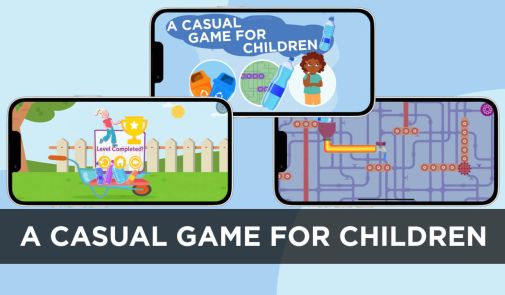

I’ve been working with VironIT almost a year. We have built together several software solutions and platforms. VironIT performance is unbelievable high. Working with VironIT is easy. I strongly recommend this company.

– Janis Kondrats, CTO at Anatomy Next