How to Build a Cryptocurrency Exchange App in 2022

Do you plan to start a cryptocurrency exchange business? If so, now is a perfect time. The global cryptocurrency market was estimated to be worth $1.49 billion in 2020 and is projected to reach $4.94 billion by 2030, growing 12.8% per year from 2021 to 2030.

The easiest way to make money from cryptocurrencies is to invest in any coin and speculate on price volatility. But there is another way—create a crypto-exchange application. Regardless of whether traders and investors make or lose money, the cryptocurrency exchange will remain a winner in any case. But note that starting a business is never an easy feat, especially when it’s a cryptocurrency venture. Since crypto apps are still affected by financial and regulatory risks, you should consider all possible angles: technical, legal, or related to user activity.

So, how to open a cryptocurrency exchange app? In this article, you will find detailed instructions on how to create a cryptocurrency exchange application. We will look at the main stages of the process with examples and explanations. We will also specify the estimated development cost.

Here’s What We’ll Cover

What is a Crypto Exchange App, and how Does it Work?

A crypto exchange app is a marketplace where you can buy and sell cryptocurrencies, such as Bitcoin, Ether, or Dogecoin. It works like a brokerage platform, offering a portal where you can create different order types to buy, sell, and speculate on cryptocurrencies with other users.

Crypto exchanges can be either centralized, meaning they are managed by one corporate authority, or decentralized, where they generally distribute verification powers to anyone willing to join a network and certify transactions.

Options to Create a Cryptocurrency Exchange App: Build from Scratch or Pick an Off-the-Shelf Solution?

If you want to build an Android or iOS crypto exchange app but lack the technical skills to handle it on your own, there are many ways to go about it. We recommend starting with these options:

- Purchase a white-label solution

- Develop a custom app from scratch

This way, you can get your app in front of the right people fast. Let’s take a brief look at some pros and cons.

Purchasing a White-Label Solution

If you opt for a ready-made solution, there are several options on the market, such as OpenDAX or AlphaPoint. And, certainly, they have their pros and cons.

The few advantages are the quick time to market and the relatively simple setup. That’s pretty much it.

The disadvantages of using an off-the-shelf solution include:

- Non-upgradable functionality

- Significant time for your team to get acquainted with the code

- Requirement for a full security audit from a third party to ensure the existing code is safe

- High upfront costs

In a nutshell, you have to find an existing code available for the app you want. Then you will have to hire a developer to customize and upload it to the app store—but that could take significant time and come at extra cost.

Develop a Custom App from Scratch

If you decide to go with the custom app development approach, you will be building an iterative and responsive solution with a team of professionals.

You will thus have full access to the technical support team that was involved in the development process. In other words, you will have full control over the development process, and be sure that you own the rights to the source code. All issues that may be encountered are then resolved more efficiently, and you can rebuild your entire app or parts of it if necessary.

Obviously, custom development will cost extra. However, this approach to the problem has no more drawbacks.

How to Build a Cryptocurrency Exchange App

Choose Cryptocurrency Exchange Type

First, you should choose the type of cryptocurrency exchange platform you want to build. This is a crucial step, since the type of trading platform affects the cryptocurrency exchange mechanism, the way they are stored, liquidity management, fiat trading, and other features.

There are three different types of cryptocurrency exchanges:

- Centralized crypto exchange (managed privately) — CEX

- Decentralized crypto asset exchange (no central ownership) — DEX

- Hybrid option or peer-2-peer crypto exchange

Centralized Cryptocurrency Exchanges (CEXs)

A centralized crypto exchange is the most common type of trading platform, and allows users to buy, sell, and exchange both crypto and fiat currencies. In a nutshell, the exchange acts as a trusted intermediary when dealing with financial assets.

The main advantages of centralized platforms are the speed of crypto transactions and the absence of liquidity issues.

The main weak point is security, since centralized exchanges store user funds in their wallets which, as practice shows, are often hacked. Cointelegraph revealed that hackers stole $293 million worth of digital currency from cryptocurrency exchanges in 2019.

Examples of CEXs: Binance, Coinbase, Kraken, Gemini.

Decentralized Cryptocurrency Exchanges (DEX)

A decentralized crypto exchange is a trading platform based on blockchain technology and smart contracts. It doesn’t store user assets or the personal information of fund holders. DEXs allow traders to enter into transactions directly without the involvement of intermediaries.

The role of the guarantor of the transaction is assumed by smart contracts. This allows you to save on commissions and increase the level of security.

However, keep in mind that decentralized cryptocurrency exchange platforms have some disadvantages: limited functionality, lack of fiat currency, transaction speed limited by the blockchain, and inaccessibility of margin currency.

Examples of DEXs: Uniswap, PancakeSwap, MDEX, SushiSwap.

Hybrid Cryptocurrency Exchanges

Hybrid cryptocurrency exchanges take advantage of each CEX and DEX. They combine fast transaction speeds and security assurances by retaining private keys.

For instance, transaction history could be stored on a blockchain, keeping transactions and accounts secure, and a centralized server would handle all transactions, allowing more transactions to be processed.

The most popular hybrid platforms are Nash, Qurrex, Eidoo, and Legolas.

Comparison Table: CEX vs DEX vs Hybrid App Development

Which should you choose for your business? The differences between CEX, DEX and hybrid options are best illustrated with a comparison table.

| Criteria | CEX | DEX | Hybrid |

| Liquidity | High | Low | Low |

| UI & UX | Easy to use | Hard to use | Easy to use |

| Matching speed | Very fast | Slow | Fast |

| Custody | Users trust CEX | Users own their funds | Users own their funds |

| Trading volume | High | Low | Low |

| Features | Unlimited | Limited | Limited |

| Fiat gateway | Yes | No | Yes |

Choose a Jurisdiction

Jurisdictions under which to start a crypto exchange app vary greatly from region to region, from a clear set of regulations to a complete lack of regulation. While the latter option may seem more attractive, keep in mind that sooner or later the legislative gap may be filled, and not always in favor of your business.

For example, Malta, Gibraltar, Switzerland, and Singapore now stand out as attractive countries for those wishing to open a cryptocurrency exchange. However, you will still need to keep an eye on legislative changes.

Also note that any cryptocurrency exchange must have a set of tools that allows the exchange of cryptocurrencies into a fiat currency to generate income. Therefore, you will need to find out in advance which banks you will be able to cooperate with to provide withdrawals and deposits.

So, when choosing a country, pay particular attention to the following factors:

- The state’s attitude towards cryptocurrencies

- Peculiarities of corporate legislation

- General the overall

- Political and economic stability

- Conditions of registration of cryptocurrency businesses

Think about Architecture, Technology Stack, and API

In this stage, you should define the architecture, technology stack and API of your crypto-exchange service.

Exchange Architecture

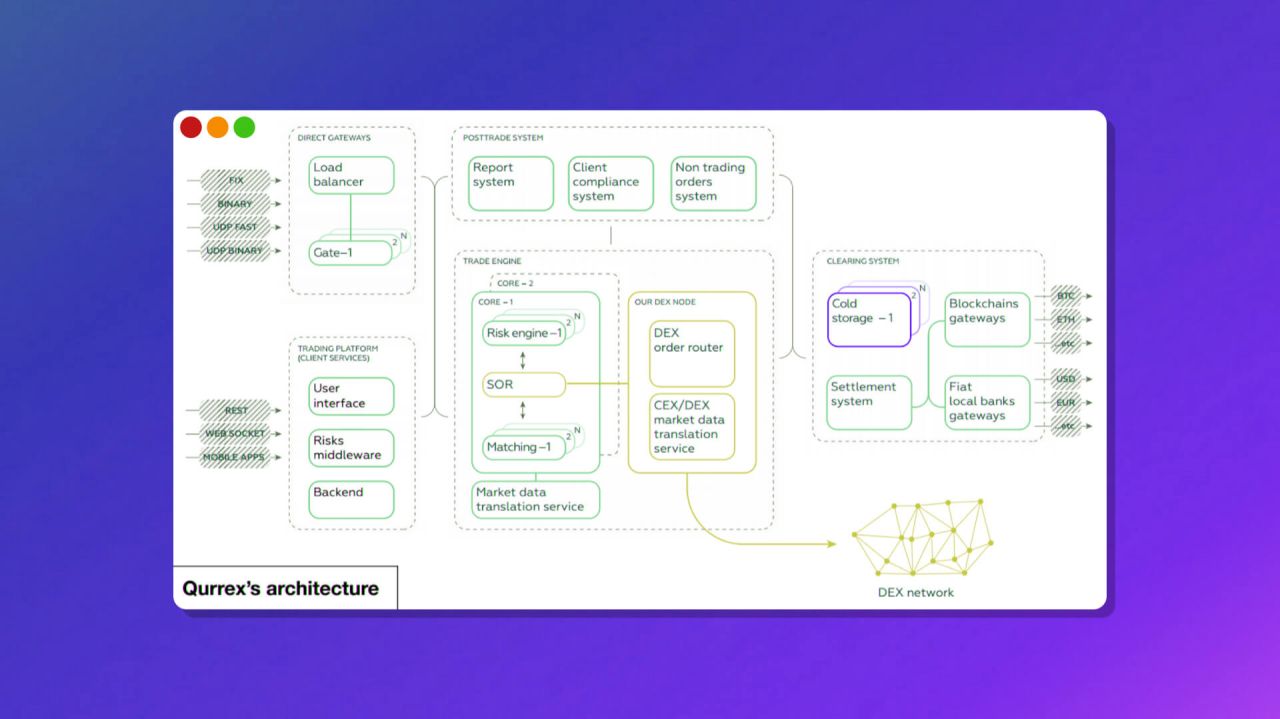

An exchange architecture usually refers to a platform structure that helps define the relationship and the way all the components of an exchange interact: the login screen, trading engine, user interface, security features, APIs, databases, etc. Following, you will find an example of such an architecture:

Note that the technical structure of exchange platforms can vary significantly. Below, we describe the main components that most services have:

-

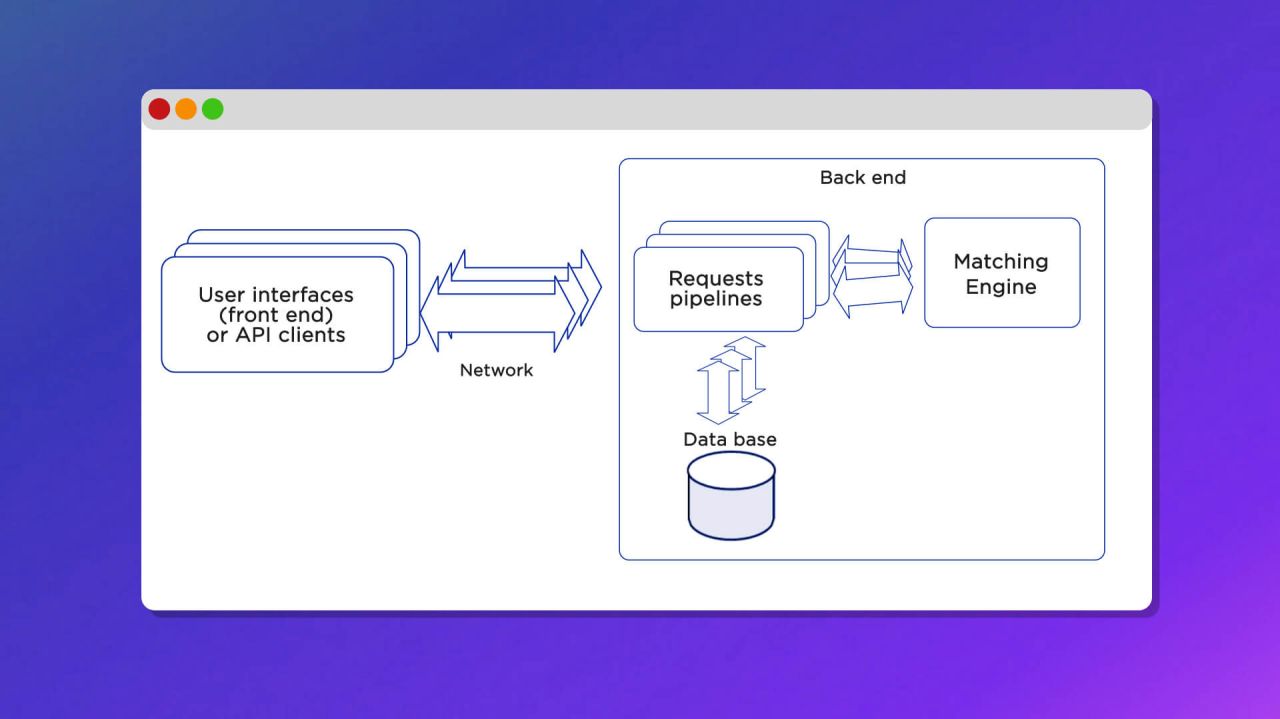

Matching engine.The matching mechanism combines the interests of buyers and the interests of sellers, resulting in transactions. Below you will find a simplified block diagram of an exchange.

The matching process for one currency pair or other trading instrument is strictly sequential.

Requests that came from users or API clients can be processed concurrently before they reach the matching engine, which is why the engine is the bottleneck for the throughput of the exchange. The number of requests that the exchange can process per second is limited by the number of requests that the matching engine can process per second.

-

User interface. According to Statista, only 9% of traders are satisfied with the crypto exchanges they use. The reason is simple: the creators of exchanges do not take into account the pain points and needs of their customers.

Thus, it is important to pay attention to the UI/UX design of your exchange platform. Its user interface should be user-friendly and adaptable for any device, such as a PC, tablet or smartphone.

- Wallet. If you create a centralized exchange, you should also create a cryptocurrency wallet, which are usually divided into two groups: cold and hot wallets. Cold wallets are used to store the main assets of the exchange, while hot wallets are used for depositing and withdrawing funds.

- Admin panel. The admin panel will help you keep track of the current status of your exchange, traders, wallets, transactions, and content. It can also be used for verifying users, changing and deleting content, banning and deleting trader accounts, changing commissions, managing marketing activities, etc.

Find a Liquidity Provider

The success and competitiveness of your exchange business will greatly depend on liquidity: how long it takes to exchange an asset for its money equivalent. As you know, customers will always choose an exchange with good liquidity that can offer a narrower spread.

To find a reliable liquidity provider, it is important to pay attention to the following:

- First, you need to evaluate the available providers from a cost-effectiveness perspective.

- Then, compare them in terms of the number of instruments offered, trading conditions, availability of margin trading, and protocols used.

- Once you have evaluated prices and commissions, you should pick a provider that best meets your requirements.

Take Care of Transparency & Security

The cryptocurrency market attracts not only new members but also scammers. Even the largest exchanges, like Binance or Poloniex, aren’t always able to resist hacking attacks.

Therefore, owners of cryptocurrency exchanges should constantly improve the security of their apps by various methods. These may include two-factor authentication, the use of cold and hot wallets, database encryption, anti-phishing features, specific IP address, and other technologies.

Test your Crypto Exchange

The complexity of an exchange application creates countless problems that the development team has to deal with. Are you ready to discover possible flaws and find the best ways to fix them?

If so, then it’s time to test your application. Note that the scope of testing should cover an assessment of overall system performance, functionality, speed, and security.

For example, you can implement the following testing practices:

- Vulnerability testing

- KYC verification testing

- Deposit and withdrawal testing

- Cryptocurrency purchase and sale testing

- Testing of APIs or WebSockets

Remember also to collect user feedback and make necessary improvements to ensure smooth operation and improve the user experience.

Ensure the Sustainability of Business Processes

In addition to preparing for the launch and gaining an initial customer base, you should implement processes that will improve user loyalty.

- Provide ongoing customer support. High-quality customer support that meets customer requests immediately will serve as an additional marketing tool.

- Take care of your asset management strategy. Developing an asset management strategy in advance will help you quickly adapt to any unexpected challenges the market may present.

- Boost your team. In a nutshell, outsource first, hire later. Outsourcing allows you to cut down on office rental and equipment costs, minimize internal workflow, and choose employees from the global talent pool.

If you decide to outsource, we recommend that you follow our detailed instructions—How to Outsource App Development.

How Much does it Cost to Build a Cryptocurrency Exchange App?

The cost of making a crypto exchange app can be affected by geographic location, app complexity, and local market conditions, among other factors. For example:

- Are you building a DEX or CEX?

- Do you require an iOS, Android, or cross-platform mobile app?

- Would you like to apply an open-source trading engine?

Developing an MVP exchange app can cost between $50,000 and $90,000, whereas developing an advanced app can range from $100,000 to upwards of $150,000.

Below are some average development cost estimates for the most popular cryptocurrency exchange apps.

Cost to Develop a Cryptocurrency App like Binance

Binance is a popular cryptocurrency exchange that offers low trading fees and a wide range of cryptocurrencies. While its affordable fees might be appealing, the platform has run into regulatory issues and is currently under investigation in the U.S.

The development cost of a cryptocurrency exchange platform like Binance may vary from $100,000 to $150,000.

Cost to Build Cryptocurrency Exchange like Crypto.com

Crypto.com is a cryptocurrency exchange that supports trading, investing, staking, wallets, NFTs, and more. This exchange offers more than 150 different currencies, reasonable fees, and discounts for those who hold a significant stake in Crypto.com Coin (CRO).

Building a cryptocurrency exchange like Crypto.com from scratch will cost around $50,000 to $100,000.

Cost to Develop a Cryptocurrency App like Coinbase

Coinbase is a cryptocurrency exchange that offers users the ability to buy, sell, and exchange over 100 tradable cryptocurrencies such as Bitcoin, Ethereum, and Dogecoin. But pay attention to the fact that it’s characterized by high commissions.

The cost to develop an app like Coinbase will range somewhere from $50,000 to $120,000.

Want Expert Advice on your App Idea? Discuss it with VironIT’s Developers

We have covered the basic steps to create a cryptocurrency exchange app. You can add more features using certain libraries to make your app more attractive.

If you don’t want to spend too much money on creating an app from scratch, contact us. And since we have extensive experience in creating various cryptocurrency applications, we can help you save time and budget on development.